United States

Securities & Exchange Commission

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12. |

| First Savings Financial Group, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| N/A | |

| (2) | Aggregate number of securities to which transactions applies: |

| N/A | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| N/A | |

| (4) | Proposed maximum aggregate value of transaction: |

| N/A | |

| (5) | Total fee paid: |

| N/A | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| N/A | |

| (2) | Form, Schedule or Registration Statement No.: |

| N/A | |

| (3) | Filing Party: |

| N/A | |

| (4) | Date Filed: |

| N/A |

January 13, 20217, 2022

Dear Fellow Shareholder:

You are cordially invited to attend the 20212022 annual meeting of shareholders (the “Annual Meeting”) of First Savings Financial Group, Inc. (the “Company”). The meetingAnnual Meeting will be held at the First Savings Bank Center located at 702 North Shore Drive, Jeffersonville, Indiana, on Tuesday, February 16, 2021,8, 2022, at 2:00 p.m., local time.

The notice of the Annual Meeting and accompanying proxy statement appearing on the following pages describe the formal business to be transacted at the meeting.Annual Meeting. Directors and officers of the Company, as well as representatives of Monroe Shine & Co., Inc., the Company’s independent registered public accounting firm, will be present to respond to appropriate questions from shareholders.

It is important that your shares are represented at the meeting,Annual Meeting, regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote by promptly by completing and mailing the enclosed proxy card or by voting via the Internet or by telephone. Internet and telephone voting instructions appear on the enclosed proxy card.

| Sincerely, | ||

| ||

| Larry W. Myers | ||

| President and Chief Executive Officer |

Special Notice Regarding In-Person Attendance at Annual Meeting – In light of the ongoing health risks relating to the COVID-19 pandemic and to best protect the health and welfare of our employees, shareholders and community, we urge that shareholders DO NOT ATTEND the Annual Meeting in person this year. Shareholders are nevertheless urged to vote their proxies by mail or by voting via the Internet or by telephone today.

FIRST SAVINGS FINANCIAL GROUP, INC.

First Savings Bank Center

702 North Shore Drive, Suite 300

Jeffersonville, Indiana 47130

(812) 283-0724

NOTICE OF 20212022 ANNUAL MEETING OF SHAREHOLDERS

| TIME AND DATE | 2:00 p.m., local time, on Tuesday, February | |

| PLACE | First Savings Bank Center | |

702 North Shore Drive | ||

Jeffersonville, Indiana | ||

| ITEMS OF BUSINESS | (1) | To elect four directors to serve for a term of three years. |

| (2) | To | |

| To |

| To transact such other business as may properly come before the meeting and any adjournment or postponement of the meeting. | ||

| RECORD DATE | In order to vote, you must have been a shareholder at the close of business on December 31, | |

| PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares via the Internet, by telephone or by completing and returning the proxy card or voting instruction card sent to you. You can revoke your proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. | |

| By Order of the Board of Directors, | ||

| ||

| ||

| Tony A. Schoen | ||

| Corporate Secretary | ||

| ||

| ||

Special Notice Regarding In-Person Attendance at Annual Meeting – In light of the ongoing health risks relating to the COVID-19 pandemic and to best protect the health and welfare of our employees, shareholders and community, we urge that shareholders DO NOT ATTEND the Annual Meeting in person this year. Shareholders are nevertheless urged to vote their proxies today by mail or by voting via the Internet or by telephone.Jeffersonville, Indiana

January 7, 2022

FIRST SAVINGS FINANCIAL GROUP, INC.

Proxy Statement

FOR

20212022 ANNUAL MEETING OF SHAREHOLDERS

GENERAL INFORMATION

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of First Savings Financial Group, Inc. (the “Board”) for the Annual Meeting and for any adjournment or postponement of the Annual Meeting. In this proxy statement, we may also refer to First Savings Financial Group as the “Company,” “we,” “our” or “us.”

First Savings Financial Group is the holding company for First Savings Bank. In this proxy statement we may also refer to First Savings Bank as the “Bank.”

We will hold the Annual Meeting at the First Savings Bank Center located at 702 North Shore Drive, Jeffersonville, Indiana, on Tuesday, February 16, 20218, 2022 at 2:00 p.m., local time.

We are mailing this proxy statement and the enclosed proxy card to shareholders of record beginning on or about January 13, 2021.7, 2022.

First Savings Financial Group is the holding company for First Savings Bank. In this proxy statement we may also refer to First Savings Bank as the “Bank.”

SPECIAL NOTICE REGARDING IN-PERSON ATTENDANCE AT ANNUAL MEETING3-FOR-1 STOCK SPLIT DISTRIBUTED ON SEPTEMBER 15, 2021

GivenAll numerical data related to shares of the ongoing health risks relating toCompany’s common stock presented in this proxy statement reflect the COVID-19 coronavirus pandemic3-for-1 stock split paid in the form of a stock dividend and the evolving public health measures being instituted by public officials, and to best protect the health and welfare of our employees, shareholders and community, we urge that shareholders DO NOT ATTEND the Annual Meeting in person this year. Stockholders are nevertheless urged to vote their proxies today by mail or by voting via the Internet or by telephone. See “Information About Voting – Voting by Proxy” below.distributed on September 15, 2021.

Important Notice Regarding the Availability of Proxy Materials

for the SHAREHOLDERS’ Meeting to be held on FEBRUARY 16, 20218, 2022

This proxy statement and the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”), are available at www.proxyvote.com.

INFORMATION ABOUT VOTING

Who Can Vote at the Meeting

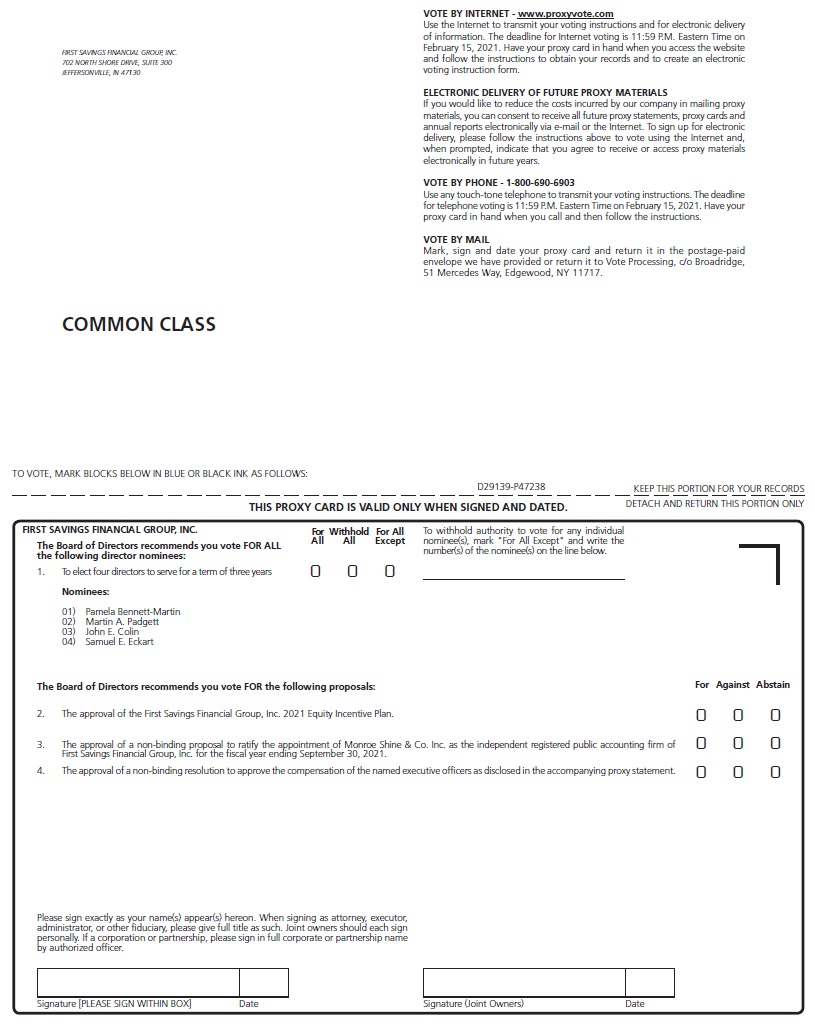

You are entitled to vote your shares of Company common stock that you owned as of December 31, 2020.2021. As of the close of business on that date, 2,373,7277,338,245 shares of Company common stock were outstanding. Each share of Company common stock has one vote.

The Company’s Articles of Incorporation provides that record holders of Company common stock who beneficially own, either directly or indirectly, more than 10% of outstanding Company common stock are not entitled to any vote with respect to those shares that exceed the 10% limit.

Ownership of Shares; Attending the Meeting

You may own shares of the Company in one or more of the following ways:

| · | Directly in your name as the shareholder of record; |

| · | Indirectly through a broker, bank or other holder of record in “street name”; |

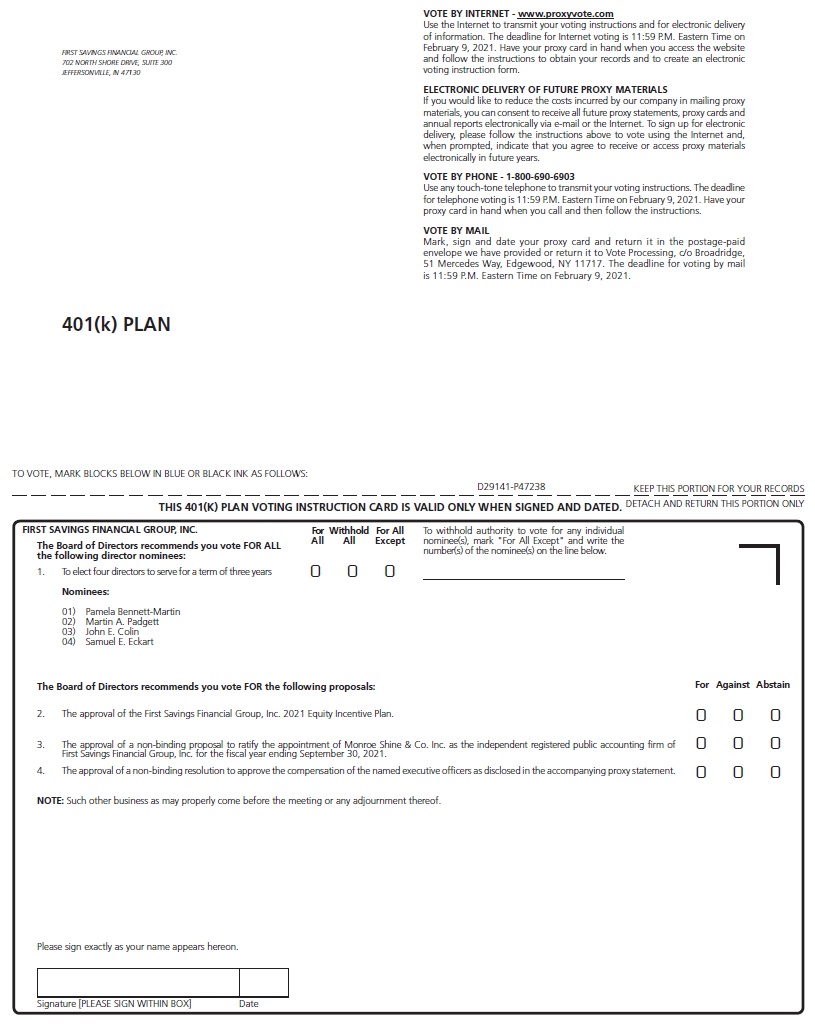

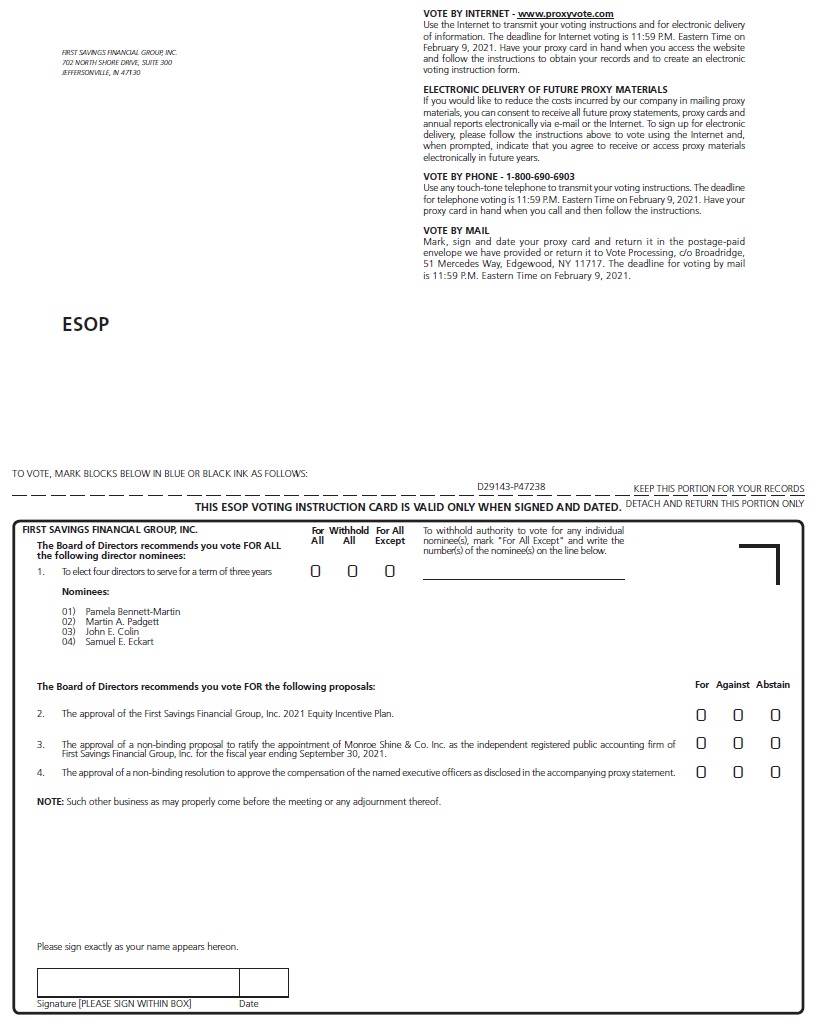

| · | Indirectly through the First Savings Bank Employee Stock Ownership Plan (the “ESOP”); or |

| · | Indirectly through the First Savings Bank Profit Sharing/401(k) Plan (the “401(k) Plan”). |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the meeting.

If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone or by the Internet. See the instruction form provided by your broker, bank or other holder of record that accompanies this proxy statement. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. Examples of proof of ownership are a recent brokerage statement or a letter from a bank or broker. If you want to vote your shares of Company common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other nominee who is the record holder of your shares.

If you own shares of Company common stock indirectly through the ESOP or the 401(k) Plan, see “ESOP and 401(k) Plan Participant Voting” for voting information.

Quorum and Voting

Quorum. We will have a quorum and will be able to conduct the business of the Annual Meeting if the holders of a majority of the outstanding shares of Company common stock entitled to vote are present at the meeting, either in person or by proxy.

Vote Required for Proposals. Shareholders will elect four directors to serve for a term of three years. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast in the election of directors at the Annual Meeting, meaning that the nominees receiving the greatest number of votes will be elected up to the maximum number of directors to be elected at the Annual Meeting. The maximum number of directors to be elected at the Annual Meeting is four.

In voting on the approval of the First Savings Financial Group, Inc. 2021 Equity Incentive Plan (the “2021 Equity Incentive Plan”), you may vote in favor of the proposal, vote against the proposal or abstain from voting. To approve the 2021 Equity Incentive Plan, the affirmative vote of a majority of the votes cast at the Annual Meeting is required.

In voting on the ratification of the appointment of Monroe Shine & Co., Inc. (“Monroe Shine”) to serve as the Company’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the appointment of Monroe Shine, the affirmative vote of a majority of the votes cast on this proposal at the Annual Meeting is required.

In voting on the non-binding resolution to approve the compensation of the named executive officers, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To approve the non-binding resolution, the affirmative vote of a majority of the votes cast on this proposal at the Annual Meeting is required.

How We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposals to approve the 2021 Equity Incentive Plan andproposal to ratify the appointment of the independent registered public accounting firm, abstentions and broker non-votes will have no effect on the outcome of the vote on the proposals.this proposal. Similarly, abstentions and broker non-votes will have no effect on the outcome of the non-binding vote on the compensation of the named executive officers.

Effect of Not Casting Your Vote

If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors (Item 1), in the vote to approve the 2021 Equity Incentive Plan (Item 2) and in the advisory vote regarding the compensation of our named executive officers (Item 4)3). Current regulations prohibit your bank or broker from voting your uninstructed shares in the election of directors and on certain other matters on a discretionary basis. Therefore, if you hold your shares in street name and you do not instruct your bank or broker how to vote on Items 1 2 and 4,3, no votes will be cast on these matters on your behalf. These are referred to as broker non-votes. Your bank or broker does, however, have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Item 3)2).

Voting by Proxy

We are sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the Annual Meeting by the persons named in the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Board. The Board unanimously recommends that you vote:

| · | “ |

| · | “ |

| · | “ |

If any matters not described in this proxy statement are properly presented at the Annual Meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the Annual Meeting to solicit additional proxies. If the Annual Meeting is postponed or adjourned, your shares of Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided that the new meeting occurs within 30 days of the original date of the Annual Meeting and you have not revoked your proxy. We do not currently know of any other matters to be presented at the Annual Meeting.

Instead of voting by completing and mailing a proxy card, registered shareholders can vote their shares of Company common stock via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, allow shareholders to provide their voting instructions and confirm that their instructions have been recorded properly. Specific instructions for Internet and telephone voting appear on the enclosed proxy card and for the benefit plans on the voting instruction cards. The deadline for voting via the Internet or by telephone is 11:59 p.m., Eastern Time, on Monday, February 15, 2021.7, 2022.

ESOP and 401(k) Plan Participant Voting

If you participate in the ESOP or invest in Company common stock through the 401(k) Plan, you will receive a voting instruction card for each plan that reflects all shares you may direct the trustees to vote on your behalf under the plan. You may submit your voting instruction cards, or convey your voting instructions via the Internet, by telephone or by mail. Specific instructions for Internet or telephone submission are set forth on the voting instruction cards. Under the terms of the ESOP, all allocated shares of Company common stock held by the ESOP are voted by the ESOP trustee, as directed by plan participants. The ESOP trustee generally votes all unallocated shares of Company common stock held by the ESOP and allocated shares for which no timely voting instructions are received in the same proportion as shares for which the ESOP trustee has received timely voting instructions, subject to the exercise of its fiduciary duties. Under the terms of the 401(k) Plan a participant may direct the trustee how to vote the shares of Company common stock credited to the Participant under the plan. The Company will direct the 401(k) Plan trustee how to vote the shares of Company common stock for which timely voting instructions are not received. The deadline for returning your voting instruction cards is Tuesday, February 9, 2021.1, 2022.

Revoking Your Proxy

Whether you vote or direct your vote by mail, telephone or via the Internet, if you are a registered shareholder or a participant in the ESOP and/or the 401(k) Plan, unless otherwise noted, you may later revoke your proxy by:

| · | sending a written statement to that effect to the Company’s Corporate Secretary; |

| · | submitting a properly signed proxy card or voting instruction card with a later date; |

| · | voting by telephone or via the Internet at a later time (if initially able to vote in that manner) so long as such vote or voting direction is received by the applicable date and time set forth above for registered shareholders and participants in the ESOP and/or the 401(k) Plan; or |

| · | voting in person at the Annual Meeting (except for shares held in the ESOP and/or the 401(k) Plan). |

If you hold your shares through a bank, broker, trustee or nominee and you have instructed the bank, broker, trustee or nominee to vote your shares, you must follow the directions received from your bank, broker, trustee or nominee to change those instructions.

CORPORATE GOVERNANCE

Director Independence

The Board currently consists of eleven members, all of whom are considered independent under the listing requirements of the NASDAQNasdaq Stock Market except for Larry W. Myers and John P. Lawson, Jr. Mr. Myers is not considered independent because he is employed as an executive officer of both the Company and the Bank. Mr. Lawson is not considered independent because he was employed as an executive officer of both the Company and the Bank during the past three years. In determining the independence of directors, the Board considered the various deposit, loan and other relationships that each director and director nominee has with the Bank, including loans and lines of credit outstanding to Pamela Bennett-Martin, and L. Chris Fordyce and Martin A. Padgett, in addition to the transactions disclosed under “Other Information Relating to Directors and Executive Officers—Transactions with Related Persons”, but determined in each case that these relationships did not interfere with their exercise of independent judgment in carrying out their responsibilities as directors.

Board Leadership Structure and Board’s Role in Risk Oversight

The Board has determined that the separation of the offices of Chair of the Board and of President and Chief Executive Officer enhances Board independence and oversight. Moreover, the separation of those offices allows the President and Chief Executive Officer to better focus on his increasing responsibilities of managing the Company, enhancing shareholder value, and expanding and strengthening the Company’s franchise while allowing the Chair of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. Consistent with this determination, John E. Colin serves as Chair of the Board and Lead Director and Martin A. Padgett serveserves as Vice-Chair of the Board. Messrs. Colin and Padgett are considered independent directors under the listing requirements of the NASDAQNasdaq Stock Market.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. The Company faces numerous risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputation risk. Management is responsible for the daily management of risks the Company faces, while the Board (as a whole) and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. To do this, both the Chair and Vice-Chair of the Board meet regularly with management to discuss strategy and the risks facing the Company. Senior management attends the Board meetings and is available to address any questions or concerns raised by the Board on risk management and any other matters. Both the Chair and Vice-Chair of the Board and the other independent members of the Board work together to provide strong, independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings of independent directors.

Corporate Governance Policy

The Board has adopted a corporate governance policy to govern certain activities, including: the duties and responsibilities of directors; the composition, responsibilities and operations of the Board; the establishment and operation of Board committees; succession planning; convening executive sessions of independent directors; the Board’s interaction with management and third parties; and the evaluation of the performance of the Board and of the President and Chief Executive Officer.

Board Committees

The following table identifies the Board’s standing committees and their members as of September 30, 2020.2021. All members of each committee are independent in accordance with the listing requirements of the NASDAQNasdaq Stock Market. Each committee operates under a written, Board-approved charter that is approved by the Board and that governs its composition, responsibilities and operation. Each committee reviews and reassesses the adequacy of its charter at least annually. The charter of each committee is available at the Investor Relations section of the Bank’s website (www.fsbbank.net).

| Director | Audit Committee | Compensation Committee | Nominating/ Corporate Governance Committee | Audit Committee | Compensation Committee | Nominating/ Corporate Governance Committee | ||||||||||||

| John E. Colin | X | X | X | X | ||||||||||||||

| Frank N. Czeschin | X | X | X | X | ||||||||||||||

| Samuel E. Eckart | X | X | ||||||||||||||||

| L. Chris Fordyce | Chair | X (Chair) | ||||||||||||||||

| Troy D. Hanke | X | X | ||||||||||||||||

| John P. Lawson, Jr. | ||||||||||||||||||

| Pamela Bennett-Martin | Chair | X (Chair) | ||||||||||||||||

| Larry W. Myers | ||||||||||||||||||

| Martin A. Padgett | X | X | X | X | X | X | ||||||||||||

| Steven R. Stemler | X | X | ||||||||||||||||

| Douglas A. York | Chair | X (Chair) | ||||||||||||||||

| Number of meetings in fiscal 2020 | 6 | 4 | 2 | |||||||||||||||

| Number of meetings in fiscal 2021 | 5 | 6 | 1 | |||||||||||||||

Audit Committee

The Audit Committee assists the Board in fulfilling its responsibilities in connection with the Company’s (i) independent registered public accountants, (ii) internal auditors, (iii) financial statements, (iv) earnings releases and guidance, (v) financial and capital structure and strategy, and (vi) compliance program, internal controls and risk management. All members of the Audit Committee are considered independent under NASDAQthe Nasdaq Stock Market listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended. Certain members of the Audit Committee are partners, controlling shareholders or executive officers of an organization that has a lending relationship with the Bank, or individually maintain such relationships. The Board has determined that such lending relationships do not interfere with the director’s exercise of independent judgment. The Board has determined that Douglas A. York, Martin A. Padgett and Troy D. Hanke, each a licensed Certified Public Accountant, are “audit committee financial experts” as defined in Item 407 of SEC Regulation S-K and that they are independent as that term is used in Item 7 of SEC Schedule 14A. The Company has adopted a formal charter for the Audit Committee and the Audit Committee has reviewed and assessed the adequacy of the written charter during the past year.

Compensation Committee

The Compensation Committee approves the compensation objectives for the Company and the Bank, establishes the compensation for the Company’s and the Bank’s executive management, and conducts the performance review of the President and Chief Executive Officer. The Compensation Committee reviews all components of compensation, including salaries, cash incentive and bonus plans, equity-based incentive plans, long-term incentive plans, various employee benefit matters, and director compensation. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board. The Compensation Committee also assists the Board and executive management in evaluating potential candidates for select executive positions.

During the fiscal year ended September 30, 2020,2021, the Compensation Committee engaged ChaseCompGroup, LLC, an independent compensation consultant, to provide consulting services with respect to the Company’s directors’ fees relative to peers,annual incentive and equity-based compensation for the Company’s and the Bank’s executive and senior management relative to peers and terms of the 2021 Equity Incentive Plan, on which the shareholders will vote at the Annual Meeting.. The fees paid for these consulting services were approximately $32,330.$20,352.

Nominating/Corporate Governance Committee

The Nominating/Corporate Governance Committee assists the Board in identifying individuals qualified to become Board members, consistent with criteria approved by the Board; recommending director nominees to the Board the for the Company’s next annual meeting of shareholders; implementing policies and practices relating to corporate governance, including implementation of and monitoring adherence to corporate governance guidelines; leading the Board in its annual review of the Board’s performance; and recommending director nominees for each committee.

Minimum Qualifications for Director Nominees. The Nominating/Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board. A candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include an age limitation and a requirement that the candidate has not been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

If a candidate is deemed eligible for election to the Board, the Nominating/Corporate Governance Committee will then evaluate the following criteria in selecting nominees:

| · | contributions to the range of talent, skill and expertise of the Board; |

| · | financial, regulatory and business experience, knowledge of the banking and financial service industries, familiarity with the operations of public companies and ability to read and understand financial statements; |

| · | familiarity with the Company’s market area and participation in and ties to local businesses and local civic, charitable and religious organizations; |

| · | personal and professional integrity, honesty and reputation; |

| · | the ability to represent the best interests of the shareholders of the Company and the best interests of the Company and the Bank; |

| · | the ability to devote sufficient time and energy to the performance of his or her duties; |

| · | independence, as is defined under applicable SEC and stock exchange listing criteria; and |

| · | investment in equity holdings in the Company. |

The Nominating/Corporate Governance Committee also will consider any other factors it deems relevant, including diversity, competition, size of the Board and regulatory disclosure obligations.

With respect to nominating an existing director for re-election to the Board, the Nominating/Corporate Governance Committee will consider and review an existing director’s attendance and performance at Board meetings and at meetings of committees on which he or she serves; length of Board service; experience, skills and contributions that the existing director delivers to the Board; and independence.

Director Nomination Process. The process that the Nominating/Corporate Governance Committee follows to identify and evaluate individuals to be nominated for election to the Board is as follows:

For purposes of identifying nominees for the Board, the Nominating/Corporate Governance Committee relies on personal contacts of its committee members and other members of the Board, as well as its knowledge of members of the communities served by the Bank. The Nominating/Corporate Governance Committee will also consider director candidates recommended by shareholders according to the policy and procedures set forth below.

During the fiscal year ended September 30, 2020,2021, the Nominating/Corporate Governance Committee engaged The Newburgh Group and York & Associates, both independent executive search firms, to identify potential nominees for the Board. TheNo fees were paid for these recruitment services were approximately $800.services.

In evaluating potential nominees, the Nominating/Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the Board by evaluating the candidate under the criteria set forth above. If such individual fulfills these criteria, the Nominating/Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Considerations of Recommendations by Shareholders.The policy of the Nominating/Corporate Governance Committee is to consider director candidates recommended by shareholders who appear to be qualified to serve on the Board. The Nominating/Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board and the Nominating/Corporate Governance Committee does not perceive a need to increase the size of the Board. To avoid the unnecessary use of the Nominating/Corporate Governance Committee’s resources, the Nominating/Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Shareholders. To submit a recommendation of a director candidate to the Nominating/Corporate Governance Committee, a shareholder should submit the following information in writing, addressed to the Chair of the Nominating/Corporate Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and serving as a director if elected; |

| 4. | As to the shareholder making the recommendation, the name and address of such shareholder as they appear on the Company’s records; provided, however, that if the shareholder is not a registered holder of Company common stock, the shareholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of Company common stock; and |

| 5. | A statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

For a director candidate to be considered for nomination at the Company’s annual meeting of shareholders, the recommendation must be received by the Nominating/Corporate Governance Committee at least 120 calendar days before the date the Company’s proxy statement was released to shareholders in connection with the Company’s prior year annual meeting of shareholders, advanced by one year.

Board and Committee Meetings

During the fiscal year ended September 30, 2020,2021, the Board held nine meetings and the Bank’s Board of the Directors held 1611 meetings. No director attended fewer than 75% of the total meetings of the Board or the Board of the Directors of the Bank and the respective committees on which such director served during fiscal 2020.2021.

Director Attendance at Annual Meetings of Shareholders

The Board encourages each director to attend the Annual Meeting. All directors attended the Company’s prior year annual meeting of shareholders.shareholders last year.

Code of Ethics and Business Conduct

The Company has adopted a code of ethics and business conduct which applies to all of the Company’s and the Bank’s directors, officers and employees. A copy of the code of ethics and business conduct is available on the Investor Relations section of the Bank’s website (www.fsbbank.net).

Anti-Hedging Policy

The Company has adopted a policy that prohibits directors, officers and employees of the Company or any of its subsidiaries, and their related persons, from purchasing or selling, or offering to purchase or offering to sell, derivative securities relating to the Company’s common stock, whether or not issued by the Company, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s common stock.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements contained in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, reasonableness of significant judgments, and clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent registered public accounting firm, Monroe Shine, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States (“GAAP”), their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee by Statement on Auditing Standards No. 1301, Communication With Audit Committees (as amended), as adoptedrequired by the Public Company Accounting Oversight Board (United States) (the “PCAOB”) in Rule 3200,Auditing Standard No. 1301, Communication With Audit Committees, by other standards of the PCAOB, by the rules of the SEC, and by other applicable regulations. The Audit Committee has received the written disclosures and the letter from the independent registered public firm required by the applicable requirements of the PCAOB’sPCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with the independent registered public accountants the independence of the independent registered public accountants from management and the Company and considered the compatibility of non-audit services rendered by the independent registered public accountants with the independent registered public accountants’ independence.

The Audit Committee discussed with the Company’s internal auditors and the independent registered public accountants the overall scope and plans for and results of their respective audits. The Audit Committee meets with the internal auditors and the independent registered public accountants, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, credit quality and the overall quality of the Company’s financial reporting.

The Audit Committee Charter provides that the Audit Committee is responsible for the appointment, compensation and oversight of the independent registered public accountants. It also confirms that the Audit Committee considers non-audit-related fees and services when addressing auditor independence. The Charter also provides that the Audit Committee review and evaluate the lead partner of the independent registered public accountants.

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended September 30, 2020,2021, for filing with the SEC.

This report is not deemed “soliciting material” or deemed to be filed with the SEC or subject to SEC Regulation 14A or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, except to the extent requested by the Company specifically requests that this report be treated as soliciting material or specifically incorporated it by reference in documentsa document otherwise filed with the SEC.

Submitted by the Audit Committee:

Douglas A. York, CPA, Chair

Frank N. Czeschin

Samuel E. Eckart

Troy D. Hanke, CPA

Martin A. Padgett, CPA, MBA, FACHE

Troy D. Hanke, CPA

Frank N. Czeschin

Samuel E. Eckart

DIRECTOR COMPENSATION

The following table provides the compensation received by individuals who served as directors, but who were not also named executive officers, of the Company during the fiscal year ended September 30, 2020.2021.

| Fees Earned or Paid in Cash | Stock Awards | Option Awards (2) | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | Fees Earned or Paid in Cash | Stock Awards | Option Awards (1) | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||||||||||||||||||||||||

| John E. Colin | $ | 27,250 | — | $ | 3,065 | $ | 2,043 | $ | 226 | $ | 32,584 | $ | 31,500 | — | $ | 3,065 | $ | 1,872 | $ | 181 | $ | 36,618 | ||||||||||||||||||||||||||

| Frank N. Czeschin | 28,500 | — | 3,065 | — | — | 31,565 | 33,000 | — | 3,065 | — | — | 36,065 | ||||||||||||||||||||||||||||||||||||

| Samuel E. Eckart | 26,000 | — | 3,065 | 6,626 | — | 35,691 | 29,500 | — | 3,065 | 7,293 | — | 39,858 | ||||||||||||||||||||||||||||||||||||

| L. Chris Fordyce | 23,500 | — | 3,065 | 2,926 | — | 29,491 | 25,000 | — | 3,065 | 3,903 | — | 31,968 | ||||||||||||||||||||||||||||||||||||

| Troy D. Hanke | 26,000 | — | — | — | — | 26,000 | 29,500 | — | 9,195 | — | — | 38,695 | ||||||||||||||||||||||||||||||||||||

| John P. Lawson, Jr. | 21,000 | — | 3,065 | 3,416 | — | 27,481 | 22,000 | — | 3,065 | 4,362 | 214 | 29,641 | ||||||||||||||||||||||||||||||||||||

| Michael F. Ludden (1) | — | — | — | 5,557 | — | 5,557 | ||||||||||||||||||||||||||||||||||||||||||

| Pamela Bennett-Martin | 26,000 | — | 3,065 | — | 40 | 29,105 | 29,500 | — | 3,065 | — | 32 | 32,597 | ||||||||||||||||||||||||||||||||||||

| Martin A. Padgett | 29,750 | — | 3,065 | 2,481 | 153 | 35,449 | 34,500 | — | 3,065 | 2,273 | 122 | 39,960 | ||||||||||||||||||||||||||||||||||||

| Steven R. Stemler | 22,250 | — | 6,130 | — | 221 | 28,601 | 23,500 | — | 3,065 | — | 282 | 26,847 | ||||||||||||||||||||||||||||||||||||

| Douglas A. York | 31,000 | — | 3,065 | — | 67 | 34,132 | 37,000 | — | 3,065 | — | 54 | 40,119 | ||||||||||||||||||||||||||||||||||||

| (1) |

| Reflects the aggregate grant date fair value for stock options computed in accordance with FASB ASC Topic 718, using the binomial option pricing model to estimate the fair value of stock option awards. Stock option awards vest in five approximately equal installments, with the first vesting occurring on the first anniversary of the grant date. The actual realized value of the stock options, if any, will depend on the extent to which the market value of Company common stock exceeds the exercise price of the stock options on the exercise date. Accordingly, there is no assurance that the realized value will be at or near the estimated value reflected in the table. |

Cash Retainer and Meeting Fees for Non-Employee Directors. The following table sets forth the applicable retainers and fees currently paid to our non-employee Bank directors and our Company directors for their service on the Board and the board of directors of the Bank.

| Board of Directors of the Bank: | ||||

| Annual Retainer – Directors | $ | 16,000 | ||

| Annual Retainer – Chair | 26,000 | |||

| Annual Retainer – Vice-Chair | 21,000 | |||

| Board of Directors of the Company: | ||||

| Annual Retainer – Directors (including Chair and Vice Chair) | $ | 22,000 | ||

| Annual Retainer – Committees: | ||||

| Audit Committee Members (except Chair) | 7,500 | |||

| Audit Committee – Chair | 15,000 | |||

| Compensation Committee Members (except Chair) | 3,500 | |||

| Compensation Committee – Chair | 7,500 | |||

| Nominating/Corporate Governance Committee Members (except Chair) | 1,500 | |||

| Nominating/Corporate Governance Committee – Chair | 3,000 |

Deferred Compensation Plan. The Company and the Bank sponsor a deferred compensation plan for eligible directors and employees. As of September 30, 2020,2021, no employees participated in the plan. The deferred compensation plan is a successor to certain director deferred compensation agreements previously entered into with certain non-employee directors of the Company and the Bank. Under the deferred compensation plan, eligible directors may elect to defer receipt of a portion their cash remuneration (including retainers and meeting fees). Participants must make their deferral elections and the timing of form of distributions under the plan in accordance with the procedures set forth in the plan. Benefits become payable under the plan upon a participant’s death, separation from service or upon a change in control. Participants may also request distributions in the event of an unforeseeable emergency. Distributions may be in the form of a lump sum or annual payments over a period of up to ten years. The Company or the Bank will credit a participant’s deferral account with interest until it is distributed to the participant. The interest rate under the plan is the prime rate on the last day of the preceding calendar quarter plus two percent. The interest rate adjusts quarterly and may not exceed eight percent.

STOCK OWNERSHIP

The following table provides information as of December 31, 2020,2021, about the persons known to the Company to be the beneficial owners of more than 5% of outstanding Company common stock. A person may be considered to beneficially own any shares of common stock over which the person has, directly or indirectly, sole or shared voting or investment power.

| Name and Address | Number of Shares Owned | Percent of Company Common Stock Outstanding (1) | Number of Shares Owned | Percent of Company Common Stock Outstanding (1) | ||||||||||||

| Financial Opportunity Fund LLC Financial Opportunity Long/Short Fund LLC FJ Capital Management LLC Martin S. Friedman Andrew José 1313 Dolley Madison Blvd., Suite 306 McLean, VA 22101 | 203,115 | (2) | 8.56 | % | ||||||||||||

| Financial Opportunity Fund LLC Financial Opportunity Long/Short Fund LLC FJ Capital Management LLC Martin Friedman 1313 Dolley Madison Blvd., Suite 306 McLean, VA 22101 | 570,519 | (2) | 7.96 | % | ||||||||||||

| Larry W. Myers 702 North Shore Drive, Suite 300 Jeffersonville, IN 47130 | 144,514 | (3) | 6.07 | 443,638 | (3) | 6.16 | ||||||||||

| First Savings Bank Profit Sharing/401(k) Plan 702 North Shore Drive, Suite 300 Jeffersonville, IN 47130 | 142,405 | 6.00 | 421,344 | 5.88 | ||||||||||||

| Wedbush Opportunity Capital, LLC Wedbush Opportunity Partners, LP 1000 Wilshire Blvd Los Angeles, CA 90017 | 130,637 | (4) | 5.50 | 391,911 | (4) | 5.47 | ||||||||||

| First Savings Bank Employee Stock Ownership Plan 702 North Shore Drive, Suite 300 Jeffersonville, IN 47130 | 119,148 | 5.02 | ||||||||||||||

| (1) | Based on |

| (2) | Based on a Schedule 13G/A filed with the SEC on February |

| (3) | Includes |

| (4) | Based on a Schedule 13G/A filed with the SEC on February 12, 2016. |

The following table provides information as of December 31, 2020,2021, about the shares of Company common stock that may be considered beneficially owned by each nominee for director, by each director continuing in office, by the named executive officers namedappearing in the Summary Compensation Table, and by all directors and executive officers of the Company as a group. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting and investment power with respect to the shares shown and none of the named individuals has pledged any of his or her shares.

| Name | Number of Shares Owned | Percent of Company Common Stock Outstanding (1) | Number of Shares Owned | Percent of Company Common Stock Outstanding (1) | ||||||||||||

| Director Nominees and Directors Continuing in Office: | ||||||||||||||||

| John E. Colin | 5,265 | (2) | * | 18,635 | (2) | * | ||||||||||

| Frank N. Czeschin | 14,947 | (3) | * | 46,241 | (3) | * | ||||||||||

| Samuel E. Eckart | 9,065 | (4) | * | 28,295 | (4) | * | ||||||||||

| L. Chris Fordyce | 13,214 | (5) | * | 41,042 | (5) | * | ||||||||||

| Troy D. Hanke | 500 | * | 3,650 | (6) | * | |||||||||||

| John P. Lawson, Jr. | 19,468 | (6) | * | 59,504 | (7) | * | ||||||||||

| Pamela Bennett-Martin | 8,398 | (7) | * | 26,594 | (8) | * | ||||||||||

| Larry W. Myers | 144,514 | (8) | 6.07 | 443,638 | (9) | 6.16 | ||||||||||

| Martin A. Padgett | 2,481 | (9) | * | 9,743 | (10) | * | ||||||||||

| Steven R. Stemler | 3,530 | (10) | * | 11,990 | (11) | * | ||||||||||

| Douglas A. York | 41,311 | (11) | 1.74 | 125,333 | (12) | 1.75 | ||||||||||

| Executive Officers Who Are Not Company Directors: | ||||||||||||||||

| Anthony A. Schoen | 59,082 | (12) | 2.48 | |||||||||||||

| Jacqueline R. Journell | 16,669 | (13) | * | |||||||||||||

| Tony A. Schoen | 188,283 | (13) | 2.62 | |||||||||||||

| Jackie R. Journell | 55,381 | (14) | * | |||||||||||||

All Directors and Executive Officers as a Group (13 persons) | 338,444 | (14) | 14.13 | 1,058,329 | (15) | 14.26 | ||||||||||

| * | Represents less than 1% of outstanding Company common stock. |

| (1) | Based on |

| (2) | Includes |

| (3) | Includes |

| (4) | Includes |

| (5) | Includes |

| (6) | Includes |

| (7) | Includes |

| (8) | Includes |

| (9) | Includes |

| (10) | Includes |

| (11) | Includes |

| (12) | Includes 60,000 shares with respect to which Mr. York disclaims beneficial ownership which are held by a limited liability company with which Mr. York is affiliated, |

| Includes |

| Includes |

| Includes |

BUSINESS ITEMS TO BE VOTED ON BY SHAREHOLDERS

Item 1 — Election of Directors

The Board currently consists of eleven members. The Board is divided into three classes, each with three-year staggered terms, with approximately one-third of the directors elected each year. All the nominees for director serve as directors of the Company and the Bank. All the directors continuing in office serve as directors of the Company and the Bank, except for Frank N. Czeschin who serves only as director of the Company.

The four nominees for election as directors, each to serve for a three-year term or until his or her successor has been duly elected and qualified, are Pamela Bennett-Martin, MartinDouglas A. Padgett,York, John E. ColinP. Lawson, Jr., Frank N. Czeschin and Samuel E. Eckart.Steven R. Stemler.

Unless you indicate that your shares should not be voted for one or more nominee(s), the Board intends to vote the proxies solicited by it in favor of the election of all the Board’s nominees. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute proposed by the Board. At this time, we know of no reason why any nominee might be unable to serve.

The Board unanimously recommends that shareholders vote “FOR” all the nominees.

Information regarding the nominees for election at the Annual Meeting and the directors continuing in office is provided below. Unless otherwise stated, he or she has held his or her current occupation for at least the last five years. His or her indicated age is as of September 30, 2020.2021.

Board Nominees for Terms Expiring in 2024

Pamela Bennett-Martin is the President and owner of Bennett & Bennett Insurance, Inc., an insurance agency. She is a former director of Community First Bank. Age 62. Director since 2009.

Ms. Bennett-Martin’s experience in the ownership and operation of a local insurance company, plus providing insurance and financial-related services in the region in which the Company conducts its business, provides the Board with valuable insight regarding the local business and consumer environment and valuable strategic positioning for financial services development. In addition to service as a director of the Company and the Bank, she served ten years as a director of Community First Bank.

Martin A. Padgett, CPA, MBA, FACHE is the Chief Executive Officer of Clark Memorial Health, a division of LifePoint Health, which is owned by certain funds managed by affiliates of Apollo Global Management, LLC. Age 55. Director since 2017 and a director of the Bank since 2015.

Mr. Padgett is a certified public accountant and a fellow in the American College of Health Executives that has more than twenty-eight years of experience in healthcare finance and administration, most recently with a hospital located within the region in which the Company conducts its business. His significant business experience in healthcare, finance, accounting and executive leadership provides the Board with unique insights into the healthcare industry and regional economic environment; enhances the Board's expertise in financial analytics; and qualifies him as a financial expert servicing on the Audit Committee.

John E. Colin serves as Chair of the Board and of the board of directors of the Bank, positions held since February 2017. Mr. Colin is a partner in the law firm of Simpson Colin, LLC. Age 50. Director since 2013 and a director of the Bank since 2011.

Mr. Colin’s experience practicing law within the region in which the Company conducts its business affords the Board in-depth knowledge and understanding of the issues facing the Bank and the Company and the skills needed to guide the Company, the Bank and their management effectively.

Samuel E. Eckart formerly served as Executive Vice President of the Company and Area President of the Bank until his retirement effective December 31, 2016. Before joining the Bank, he served as President and Chief Executive Officer and a director of Community First Bank. Age 70. Director and a director of the Bank since 2009.

Mr. Eckart’s forty-eight years of experience in the local banking industry, including fifteen years as a director of Community First Bank, provides the Company and the Bank with organizational, operational and market knowledge. In addition, as an active member of the community, he currently holds various positions in numerous local charitable and civic organizations.

Directors Continuing in Office with Terms Expiring in 20222025

Douglas A. York, CPA is Director of DMLO, a public accounting firm. Age 58.59. Director and a director of the Bank since 2008.

Mr. York is an experienced certified public accountant practicing primarily within the region in which the Company conducts its business and whose financial background qualifies him as a financial expert servicing on the Audit Committee. In addition, he possesses substantial management experience as Director of DMLO, a regional CPA firm.

John P. Lawson, Jr. formerly served as Executive Vice President and Chief Operating Officer of the Company and the Bank until his retirement effective December 31, 2019. He joined the Bank in 1988. Age 63.64. Director since 2008 and a director of the Bank since 2006.

Mr. Lawson’s thirty-one years of experience in the management of the Bank provides the Board valuable insight regarding the business and operations of the Company and the Bank. Before his affiliation with the Bank, he developed financial expertise as a financial planner. His knowledge of the Company and the Bank’s history and business operations position him well for continued service as a director of the Company and the Bank.

Frank N. Czeschin is President of Indiana Utilities Corporation, a natural gas distributor. He is a former director of Community First Bank. Age 59.60. Director since 2009.

Mr. Czeschin’s management experience in the ownership of a local utility company that operates in the region in which the Bank conducts its business, provides the Board with valuable insight regarding the local business and consumer environment. In addition to service as a director of the Company, he served ten years as a director of Community First Bank.

Steven R. Stemler is the President and Chief Executive Officer of The Stemler Corporation, a mechanical contractor. He is a former director of the Your Community Bankshares, Inc., as well as, a former member of the Indiana House of Representatives. Age 60.61. Director and a director of the Bank since 2019.

Mr. Stemler’s combination of private and public financial experience, along with his extensive knowledge of the regional economy, local customer base and the workings of state government, uniquely position him to strengthen the Board’s collective skills and experience.

Directors Continuing in Office with Terms Expiring in 2023

L. Chris Fordyce is a family-farm operator in Washington County, Indiana. He is a former director of Community First Bank. Age 65.66. Director since 2017 and a director of the Bank since 2009.

Mr. Fordyce's activities in the Washington County communities and experience in agriculture in the region in which the Company conducts its business provides the Board with insight regarding the local agricultural environment. In addition to service as a director of the Company and the Bank, he served four years as a director of Community First Bank.

Troy D. Hanke, CPA is the Chief Financial Officer and a member of Bridgeman Foods, one of the largest restaurant franchisees in the United States, which owns and operates more than 400 national-brand restaurant locations throughout the United States. Before joining the Bridgeman Foods, he was a senior manager in the audit practice of Deloitte. Mr. Hanke also serves on the boards of directors of Heartland Coca-Cola Bottling and Coca-Cola Canada. Age 51.52. Director since 2020 and a director of the Bank since 2020.

Mr. Hanke is a certified public accountant that has more than nineteen years of experience in franchise restaurant finance and operations. His tenured business experience provides the Board with unique insights into the national-brand restaurant industry and national economic environment, both in which the Company conducts commercial real estate lending.

Larry W. Myers is the President and Chief Executive Officer of the Company and the Bank. He joined the Bank in 2005 and previously served as Chief Operations Officer of the Bank. Before joining the Bank, he served as Area President of National City Bank in southern Indiana. Age 62.63. Director since 2008 and a director of the Bank since 2005.

Mr. Myers’ thirty-eightthirty-nine years of experience in the local banking industry and involvement in business and civic organizations within the region in which the Company conducts its business affords the Board valuable insight regarding business initiatives and operations of the Company and the Bank. His knowledge of the Company’s and the Bank’s business, combined with his tenure and strategic vision, position him well for continued service as a director, and as President and Chief Executive Officer of the Company and the Bank.

Directors Continuing in Office with Terms Expiring in 2024

Pamela Bennett-Martin is the President and owner of Bennett & Bennett Insurance, Inc., an insurance agency. She is a former director of Community First Bank. Age 63. Director since 2009 and a director of the Bank since 2009.

Ms. Bennett-Martin’s experience in the ownership and operation of a local insurance company, plus providing insurance and financial-related services in the region in which the Company conducts its business, provides the Board with valuable insight regarding the local business and consumer environment and valuable strategic positioning for financial services development. In addition to service as a director of the Company and the Bank, she served ten years as a director of Community First Bank.

Martin A. Padgett, CPA, MBA, FACHE is the Chief Executive Officer of Clark Memorial Health, a division of LifePoint Health, which is owned by certain funds managed by affiliates of Apollo Global Management, LLC. Age 56. Director since 2017 and a director of the Bank since 2015.

Mr. Padgett is a certified public accountant and a fellow in the American College of Health Executives that has more than twenty-nine years of experience in healthcare finance and administration, most recently with a hospital located within the region in which the Company conducts its business. His significant business experience in healthcare, finance, accounting and executive leadership provides the Board with unique insights into the healthcare industry and regional economic environment; enhances the Board's expertise in financial analytics; and qualifies him as a financial expert servicing on the Audit Committee.

John E. Colin serves as Chair of the Board and of the board of directors of the Bank, positions held since February 2017. Mr. Colin is a partner in the law firm of Simpson Colin, LLC. Age 51. Director since 2013 and a director of the Bank since 2011.

Mr. Colin’s experience practicing law within the region in which the Company conducts its business affords the Board in-depth knowledge and understanding of the issues facing the Bank and the Company and the skills needed to guide the Company, the Bank and their management effectively.

Samuel E. Eckart formerly served as Executive Vice President of the Company and Area President of the Bank until his retirement effective December 31, 2016. Before joining the Bank, he served as President and Chief Executive Officer and a director of Community First Bank. Age 71. Director since 2009 and a director of the Bank since 2009.

Mr. Eckart’s forty-nine years of experience in the local banking industry, including fifteen years as a director of Community First Bank, provides the Company and the Bank with organizational, operational and market knowledge. In addition, as an active member of the community, he currently holds various positions in numerous local charitable and civic organizations.

Executive Officers who do notWho Do Not Serve as Directors

Set forth below is information regarding our executive officers who do not serve as directors of the Company. They have held their current position for at least the last five years, unless otherwise stated. The age presented is as of September 30, 2020.2021.

AnthonyTony A. Schoen, CPA is the Chief Financial Officer of the Company and the Bank. He joined the Bank in 2007 and previously served as Assistant Controller of the Bank. Before joining the Bank, he was a manager with Monroe Shine. Director of the Bank since 2017. Age 43.44.

JacquelineJackie R. Journell, CPA is the Chief Operating Officer of the Company and the Bank. She joined the Bank in 2009 and previously served as Chief Accounting Officer of the Company and the Bank and as Controller of the Bank. Before joining the Bank, she was the Chief Financial Officer with Community First Bank. Age 53.54.

Item 2 – Approval of the 2021 Equity Incentive Plan

The Board has adopted, subject to shareholder approval, the 2021 Equity Incentive Plan. The Board believes the adoption of the 2021 Equity Incentive Plan is in the best interests of the Company and its shareholders as a means of providing the Company and the Bank with the ability to retain, reward and attract and incent employees, officers and directors to promote growth, improve performance and further align their interests with those of the Company’s shareholders through the ownership of additional Company common stock.

Why We Are Seeking Approval of the Equity Incentive Plan

Most of the companies with which we compete for directors and management-level employees are public companies that offer equity compensation as part of their overall director and officer compensation programs. The 2021 Equity Incentive Plan will provide us the flexibility we need to continue to attract and retain highly qualified individuals by offering a competitive compensation program linked to the performance of Company common stock. The Board and the Compensation Committee has considered current practices of financial institutions in our marketplace related to equity plan design and equity grant practices. The Company has also evaluated its strategic plan and believes that the 2021 Equity Incentive Plan is appropriately designed to allow us to meet our objectives.

The Company also sponsors the First Savings Financial Group, Inc. 2016 Equity Incentive Plan (the “2016 Equity Incentive Plan”). As of December 31, 2020 (the latest practicable date before the printing of this proxy statement), 300 shares of Company common stock remained available for grant as stock options (as a result of forfeitures) and 200 shares of remained available for grant as restricted stock under the 2016 Equity Incentive Plan. As of December 31, 2020, 74,158 stock options were outstanding (with a weighted average exercise price of $49.85 per share and a weighted average remaining term of 7.0 years) and 6,233 unvested shares of restricted stock were outstanding. Given the nominal amount of shares that currently remain available for grant under the 2016 Equity Incentive Plan, the Company is seeking shareholder approval for the 2021 Equity Incentive Plan.

Highlights of the 2021 Equity Incentive Plan

General

The information summarizes the material features of the 2021 Equity Incentive Plan, which is qualified in its entirety by reference to the provisions of the 2021 Equity Incentive Plan, which is attached hereto as Appendix A. In the event of conflict between the terms of this disclosure and the terms of the 2021 Equity Incentive Plan, the terms of the 2021 Equity Incentive Plan will control.

Subject to permitted adjustments for certain corporate transactions, the 2021 Equity Incentive Plan authorizes the issuance or delivery to participants of up to 118,686 shares of Company common stock pursuant to grants of incentive and non-qualified stock options, stock appreciation rights, restricted stock awards and restricted stock units.

The Compensation Committee will administer the 2021 Equity Incentive Plan. The Compensation Committee has full and exclusive power within the limitations set forth in the 2021 Equity Incentive Plan to make all decisions and determinations regarding: (1) the selection of participants and the granting of awards; (2) establishing the terms and conditions relating to each award; (3) adopting rules, regulations and guidelines for carrying out the purposes of the plan; and (4) interpreting the provisions of the plan and award agreements. The 2021 Equity Incentive Plan also permits the Compensation Committee to delegate all or part of its responsibilities and powers to any person or persons selected by it. The Compensation Committee may, subject to the limitations set forth in the 2021 Equity Incentive Plan, grant stock options, stock appreciation rights and awards of restricted stock or restricted stock units to themselves and other members of the Board.

Except for accelerating the vesting of awards to avoid the minimum vesting requirements specified in the plan or accelerating the vesting requirements applicable to an award as a result of or in connection with a change in control, the Compensation Committee has the authority to reduce, eliminate or accelerate any restrictions or vesting requirements applicable to an award at any time after the grant of the award or to extend the time period to exercise a stock option, provided the extension complies with Section 409A of the Internal Revenue Code.

Eligibility

All employees and directors of the Company and its subsidiaries, including the Bank, are eligible to receive awards under the 2021 Equity Incentive Plan, except that non-employees may not receive incentive stock options under the plan. As of December 31, 2020 (the latest practicable date before the printing of this proxy statement), there were nine non-employee directors and 688 employees of the Company and its subsidiary, the Bank, eligible to receive awards under the 2021 Equity Incentive Plan.

Types of Awards

The Compensation Committee may determine the type and terms and conditions of awards under the 2021 Equity Incentive Plan. Awards will be evidenced by award agreements approved by the Compensation Committee and delivered to participants. The award agreements will set forth the terms and conditions of each award. The Compensation Committee may grant incentive and non-qualified stock options, stock appreciation rights, restricted stock awards or restricted stock units under the plan.

Stock Options. A stock option gives the recipient or “optionee” the right to purchase shares of common stock at a specified price for a specified period of time. The exercise price may not be less than the fair market value of the common stock on the date of grant. “Fair Market Value” for purposes of the 2021 Equity Incentive Plan means, if Company common stock is listed on a securities exchange, the closing sales price of the common stock or, if Company common stock was not traded on a specific date, then on the immediately preceding date on which sales were reported. If Company common stock is not traded on a securities exchange, the Compensation Committee will determine the fair market value in good faith and on the basis of objective criteria consistent with the requirements of the Internal Revenue Code. Stock Options may not have a term longer than ten years from the date of grant.

Stock options are either “incentive” stock options or “non-qualified” stock options. Incentive stock options have certain tax advantages and must comply with the requirements of Section 422 of the Internal Revenue Code. Only employees are eligible to receive incentive stock options. Shares of common stock purchased upon the exercise of a stock option must be paid for in full at the time of exercise: (1) either in cash or with stock valued at fair market value as of the day of exercise; (2) by a “cashless exercise” through a third party; (3) by a net settlement of the stock option using a portion of the shares obtained on exercise in payment of the exercise price; (4) by personal, certified or cashiers’ check; (5) by other property deemed acceptable by the Compensation Committee; or (6) by a combination of the foregoing. Stock options are subject to vesting conditions and restrictions as determined by the Compensation Committee.

Stock Appreciation Rights. A Stock Appreciation Right, or “SAR,” is similar to a stock option and represents a contractual right to receive, in cash or shares, an amount equal to the appreciation of one share of common stock from the grant date over the exercise price of the SAR. The exercise price of a SAR may not be less than the “fair market value” of a share of common stock (determined in the same manner as with stock options). The Compensation Committee will determine the date on which each SAR may be exercised or settled, in whole or in part, and the expiration date of each SAR. However, no SAR will be exercisable more than ten years from the grant date.

Restricted Stock. A restricted stock award is a grant of common stock to a participant for no consideration, or any minimum consideration that may be required by applicable law. Restricted stock awards under the 2021 Equity Incentive Plan will be granted only in whole shares of common stock and are subject to vesting conditions and other restrictions established by the Compensation Committee consistent with the 2021 Equity Incentive Plan. Prior to awards vesting, unless otherwise determined by the Compensation Committee, the recipient of a restricted stock award may exercise voting rights with respect to the common stock subject to the award. Unless otherwise determined by the Compensation Committee, the company will immediately distribute dividends paid on unvested awards to participants.

Restricted Stock Units. Restricted stock units are similar to restricted stock awards in that the value of a restricted stock unit is denominated in shares of stock. However, unlike a restricted stock award, no shares of stock are transferred to the participant until certain requirements or conditions associated with the award are satisfied. The limitation on the number of restricted stock awards available described above also applies to restricted stock units.

Limitations on Awards Under the Equity Incentive Plan

The following limits apply to awards under the 2021 Equity Incentive Plan:

In the event of a corporate transaction involving Company common stock (including, without limitation, any stock dividend, stock split or other special and nonrecurring dividend or distribution, recapitalization, reorganization, merger, consolidation, spin-off, combination or exchange of shares), the Compensation Committee will, in an equitable manner, adjust the number and kind of securities available for grants of stock options, stock appreciation rights, restricted stock awards or restricted stock units, the number and kind of securities that may be delivered or deliverable with respect to outstanding stock options, stock appreciation rights, restricted stock awards and restricted stock units, and the exercise price of stock options.

In addition, the Compensation Committee is authorized to make certain other adjustments to the terms and conditions of stock options, stock appreciation rights, restricted stock awards and restricted stock units consistent with the terms of the plan.

The closing sale price of Company common stock as quoted on the NASDAQ Stock Market (trading symbol “FSFG”) on December 31, 2020 (the latest practicable date before the printing of this proxy statement) was $65.00.

Prohibition Against Repricing of Options. The 2021 Equity Incentive Plan provides that neither the Compensation Committee nor the Board may make any adjustment or amendment to the plan or an award that reduces or would have the effect of reducing the exercise price of a previously granted stock option.

Prohibition on Transfer. Generally, all awards, except non-qualified stock options, granted under the 2021 Equity Incentive Plan are not transferable, except by will or in accordance with the laws of intestate succession. Awards may be transferable pursuant to a qualified domestic relations order. At the Compensation Committee’s sole discretion, an individual may transfer non-qualified stock options for valid estate planning purposes in a manner consistent with the Internal Revenue Code and federal securities laws. During the life of the participant, only the participant may exercise awards. However, a participant may designate a beneficiary to exercise stock options or receive any rights that may exist upon the participant’s death with respect to awards granted under the 2021 Equity Incentive Plan.

Performance Measures

The Compensation Committee may use performance measures for vesting purposes with respect to awards granted under the 2021 Equity Incentive Plan. The performance measures may include one or more of the following: book value or tangible book value per share; basic earnings per share; basic cash earnings per share; diluted earnings per share; diluted cash earnings per share; return on equity; net income or net income before taxes; cash earnings; net interest income; non-interest income; non-interest expense to average assets ratio; cash general and administrative expense to average assets ratio; efficiency ratio; cash efficiency ratio; return on average assets; cash return on average assets; return on average shareholders’ equity; cash return on average shareholders’ equity; return on average tangible shareholders’ equity; cash return on average tangible shareholders’ equity; core earnings; operating income; operating efficiency ratio; net interest rate margin or net interest rate spread; growth in assets, loans, or deposits; loan production volume; non-performing loans; total shareholder return; cash flow; strategic business objectives, consisting of one or more objectives based upon meeting specified cost targets, business expansion goals, goals relating to acquisitions or divestitures, or goals relating to capital raising and capital management; any other measure determined by the Compensation Committee or any combination of the foregoing performance measures.

The Compensation Committee may base the measures on the performance of the Company as a whole or of any one or more subsidiaries or business units and may measure performance relative to a peer group, an index or a business plan. Performance measures may be considered as absolute measures or changes in measures. In establishing performance measures, the Compensation Committee may provide for the inclusion or exclusion of certain items.

Dividend Equivalents

The Compensation Committee is authorized to grant dividend equivalents with respect to restricted stock units available under the 2021 Equity Incentive Plan. Dividend equivalents confer on the participant the right to receive payments equal to cash dividends or distributions with respect to all or a portion of the number of shares of stock subject to the award. Unless otherwise determined by the Compensation Committee, the dividend equivalent right will be paid at the same time as the shares subject to the restricted stock unit are distributed to the participant.

Vesting of Awards

The Compensation Committee will specify the vesting schedule or conditions of each award. Unless the Compensation Committee specifies a different vesting schedule at the time of grant, awards under the 2021 Equity Incentive Plan, other than performance awards, will be granted with a vesting rate not exceeding 20% per year, with the initial installment vesting no earlier than the one-year anniversary of the date of grant. If the vesting of an award under the 2021 Equity Incentive Plan is conditioned on the completion of a specified period of service with the Company or its subsidiaries, without the achievement of performance measures or objectives, then the required period of service for full vesting will be determined by the Compensation Committee and evidenced in an award agreement. Notwithstanding anything to the contrary in the 2021 Equity Incentive Plan, at least 95% of the awards available under the plan may not vest more rapidly than over a period of one year, unless accelerated due to death, disability or involuntary termination of employment or service at or following a change in control. Unless otherwise determined by the Compensation Committee, vesting will accelerate in the event of death, disability, or upon involuntary termination of employment or service at or following a change in control or, subject to the foregoing requirements and in a manner consistent with the plan, at the discretion of the Compensation Committee.

Change in Control